Affordable Medical Insurance Options to Protect Your Future

In today's unclear times, protecting adequate medical insurance protection is crucial to guarding your future well-being. With a plethora of choices readily available in the marketplace, discovering cost effective solutions that meet your demands can feel like a complicated task. However, understanding the complexities of different wellness insurance coverage strategies and how they line up with your special scenarios can make a significant distinction in both your financial security and access to top quality medical care. By discovering an array of options from Wellness Financial savings Account (HSA) plans to Group Medical insurance options, you can take proactive actions towards ensuring your satisfaction concerning your health and wellness and economic protection.

Affordable Medical Insurance Market Options

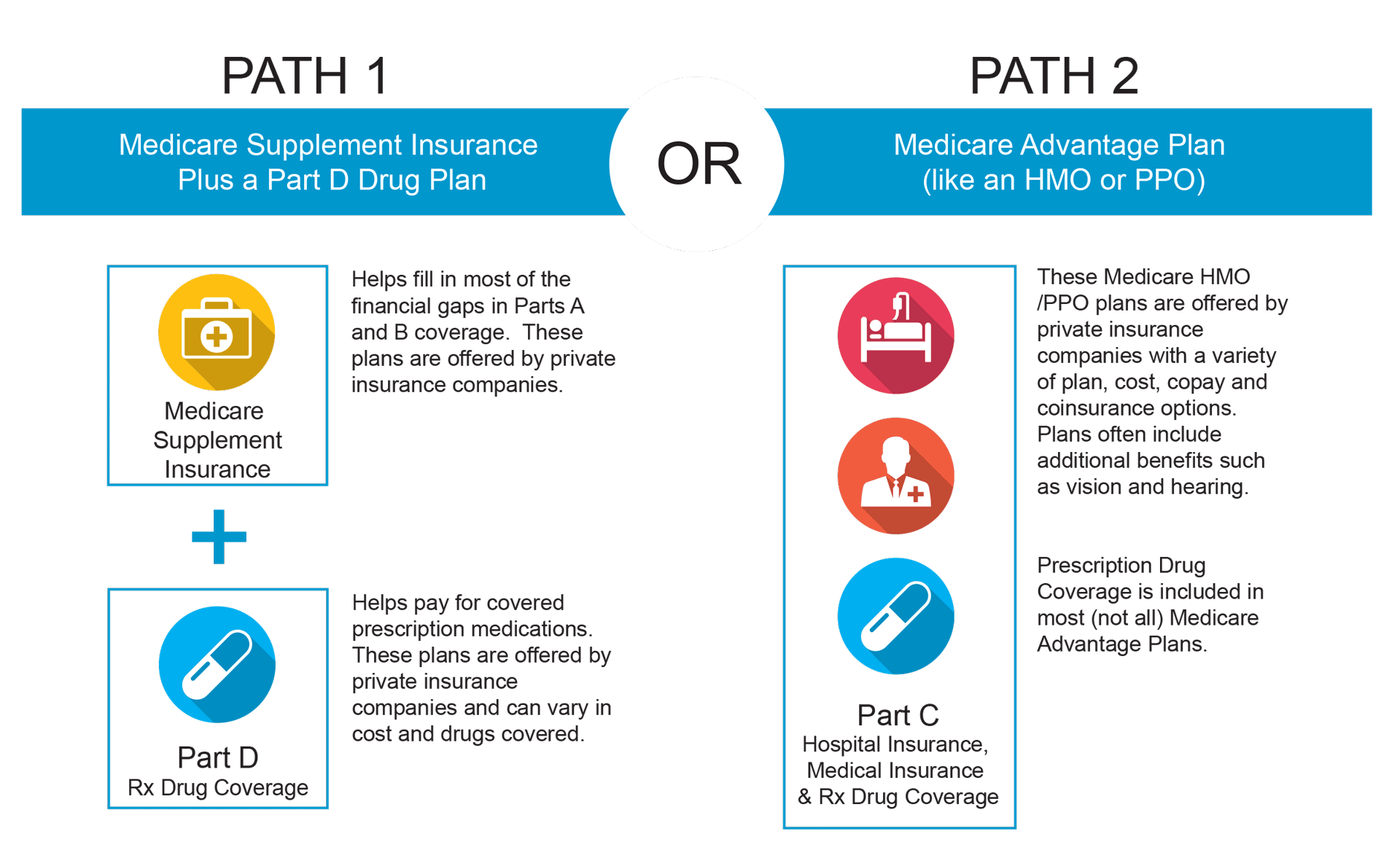

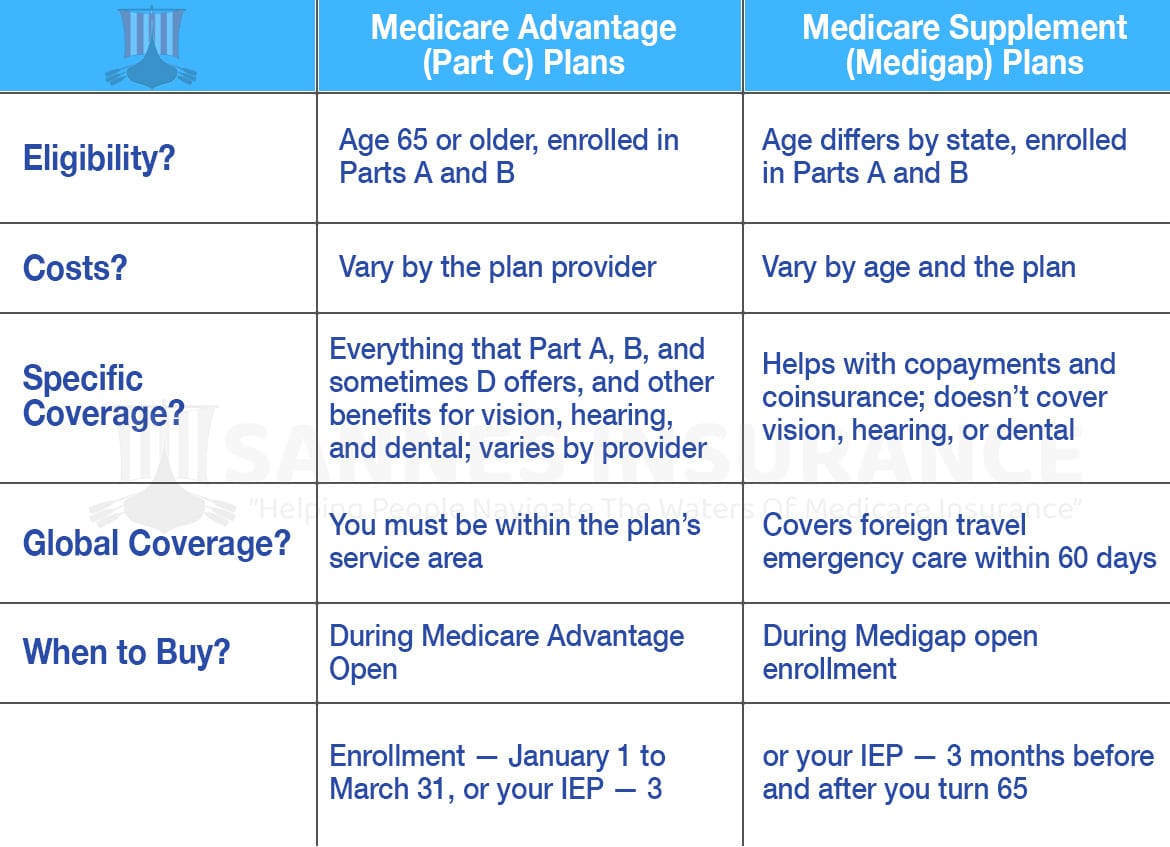

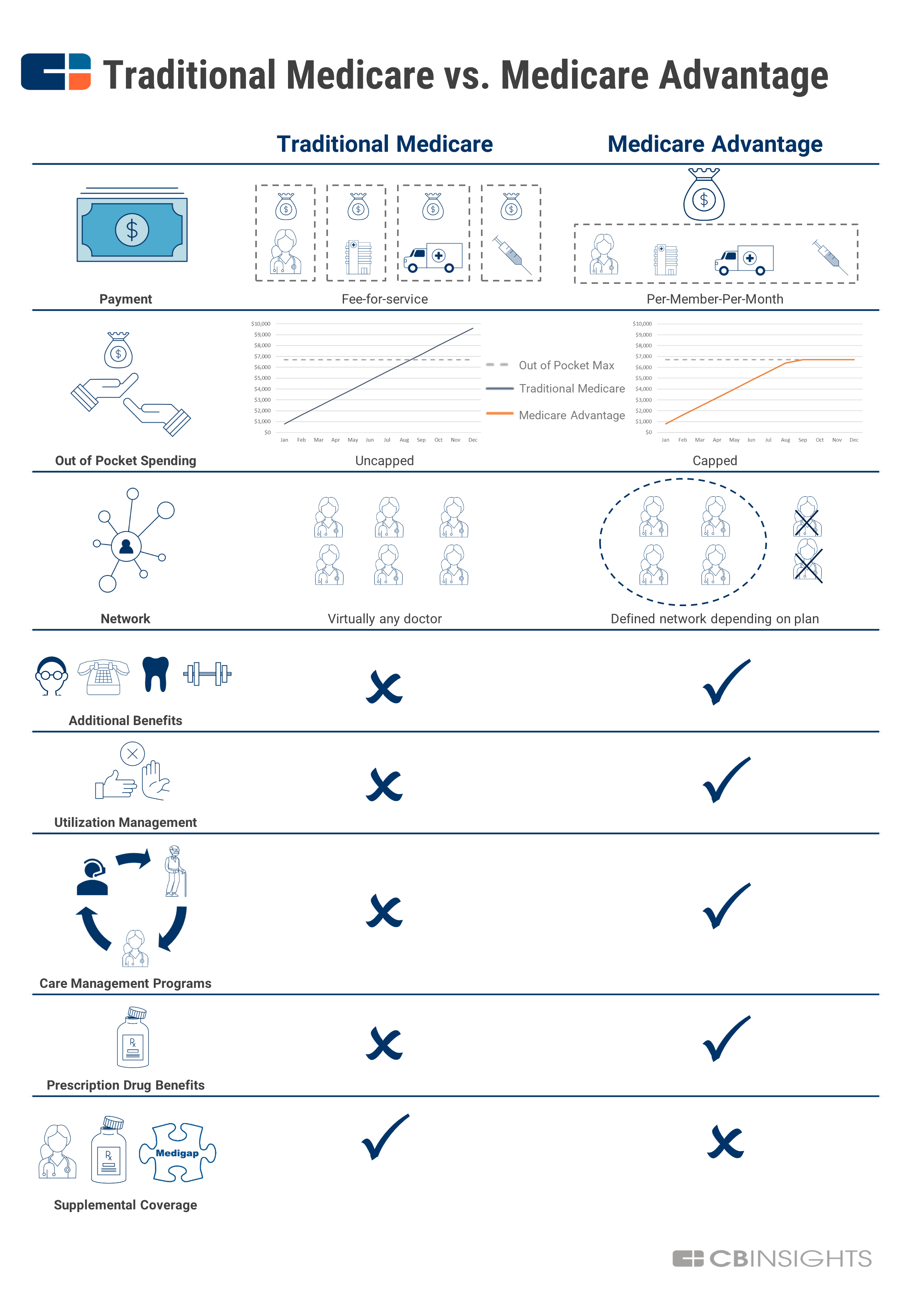

Discovering the variety of economical health and wellness insurance policy industry choices available can assist people discover a suitable strategy that fulfills their details demands and budget plan. The wellness insurance policy market uses a range of plans made to supply protection for important health benefits at different rate factors. One option within the marketplace is the Health and wellness Upkeep Organization (HMO) plan, which usually needs individuals to pick a health care medical professional and acquire recommendations for expert treatment. This plan commonly offers reduced out-of-pocket expenses and costs however restrictions insurance coverage to in-network suppliers. Another selection is the Preferred Supplier Company (PPO) strategy, which enables people to see out-of-network carriers at a greater cost but offers much more adaptability in selecting doctor without requiring recommendations. Furthermore, High-Deductible Health Plans (HDHPs) coupled with Wellness Cost savings Accounts (HSAs) provide a tax-advantaged way to save for medical expenditures while providing reduced premiums and greater deductibles. By thoroughly evaluating these industry alternatives, individuals can select a strategy that aligns with their health care needs and monetary considerations.

Health And Wellness Financial Savings Account (HSA) Plans

When considering medical insurance choices, one may locate that Wellness Cost savings Account (HSA) Strategies offer a tax-advantaged method to save for medical expenditures. HSAs are specific accounts that allow individuals with high-deductible health insurance plan to set aside pre-tax bucks to pay for competent medical expenses. Payments to an HSA are tax-deductible, and the funds in the account can be spent and expand tax-free. Among the key advantages of an HSA is that the extra funds roll over from year to year, unlike Flexible Spending Accounts (FSAs) Withdrawals for professional medical expenditures are tax-free at any time. This versatility makes HSAs a beneficial tool for conserving for present clinical prices and future healthcare requirements (self employed health insurance). Additionally, once the account holder gets to old age, HSA funds can be made use of for non-medical expenditures scot-free, although taxes would use. In General, HSA Plans supply individuals with a sensible and tax-efficient way to handle their health care expenses while saving for the future.

Short-Term Medical Insurance Solutions

Having covered the benefits of Wellness Cost savings Account (HSA) Strategies for taking care of healthcare expenses successfully, it is very important to currently change focus in the direction of going over Short-Term Medical insurance Solutions. Short-term health and wellness insurance offers momentary protection for people in requirement of instant or interim insurance coverage defense. These plans are made to link gaps in official website protection, such as during periods of transition between tasks or life conditions. Short-term medical insurance usually uses lower costs contrasted to conventional wellness insurance plans, making it a cost effective option for those looking for temporary coverage without dedicating to a long-term strategy.

One trick benefit of temporary health insurance policy is its versatility. While temporary health insurance policy may not cover pre-existing problems or use the exact same thorough advantages as long-term strategies, it supplies a valuable remedy for people needing instant, short-lived protection.

Medicaid and CHIP Coverage Benefits

Group Medical Insurance Plans

Provided the vital function Medicaid and CHIP play in giving health care coverage to prone populations, transitioning to the conversation of Team Wellness Insurance coverage Plans is vital in discovering added avenues for inexpensive and detailed clinical coverage. Group Health Insurance Strategies are policies acquired advice by employers and supplied to eligible workers as component of their benefits bundle. One of the vital advantages of group health insurance policy is that it allows for the spreading of threat among a larger swimming pool of people, which can lead to reduced premiums contrasted to individual plans.

Verdict

Finally, there are various budget-friendly wellness insurance policy alternatives available to safeguard your future. Whether with the Wellness Insurance Marketplace, Health Financial savings Account plans, short-term insurance policy options, Medicaid read what he said and CHIP insurance coverage advantages, or group wellness insurance coverage plans, it is necessary to explore and choose the very best option that fits your requirements and budget. Taking aggressive steps to secure health and wellness insurance policy coverage can give assurance and economic protection in case of unanticipated clinical expenditures.

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)